Case Study : Using the DAO LLC as a vehicle for tokenising real estate

Summary

We are pleased to announce a collaboration with Landscape Origins, a Bali based real estate company, to offer tokenisation-as-a-service to property owners looking to explore new monetisation opportunities and fractional ownership through digital assets.

Landscapeorigins.com is an established real estate agency specialising in short term and long term luxury rental properties and is looking to expand its services to allow clients to sell ‘shares’ in their properties to investors around from around the world.

In this project, Landscape Origins will act as the tokenisation operator and run the marketplace for primary token offerings, while Company DAO will provide all the necessary infrastructure, including the DAO tooling, legal framework and all the necessary payment integrations.

For Company DAO, the brief was simple. The property shares must issued as NFTs which can subsequently be traded on secondary markets, utilising 3rd party platforms like OpenSea and the holders of these tokens must have a legally sound claim on a pro rata share of any income generated by the property. Also, there has to be a simple way for the owners of these tokens to receive dividend payouts for their share of the income directly to their wallet.

The Tokenisation Process

Step 1 : The tokenisation operator purchases a DAO LLC via companydao.org to hold one or multiple properties.

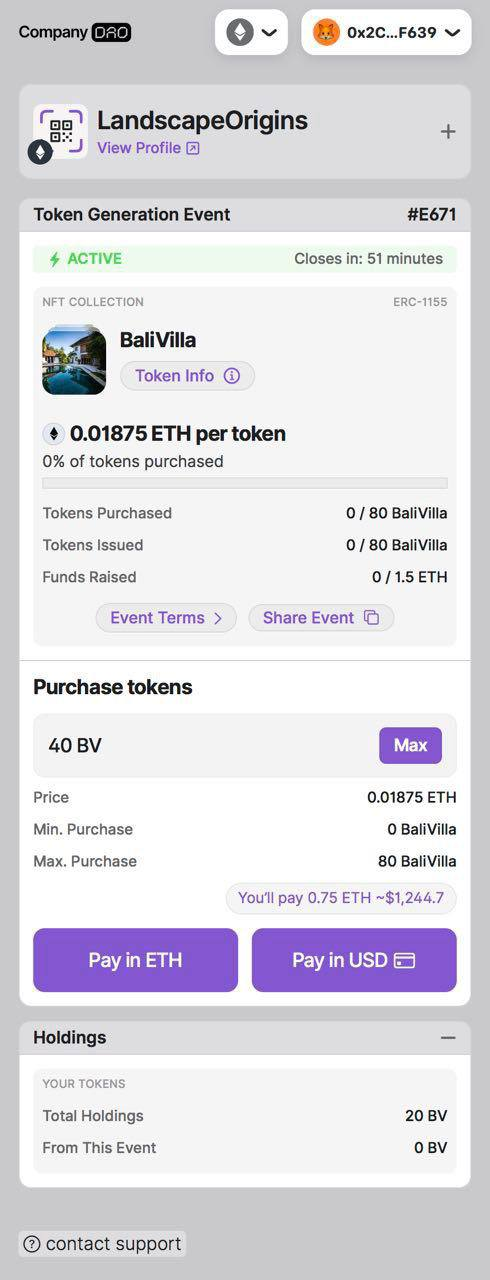

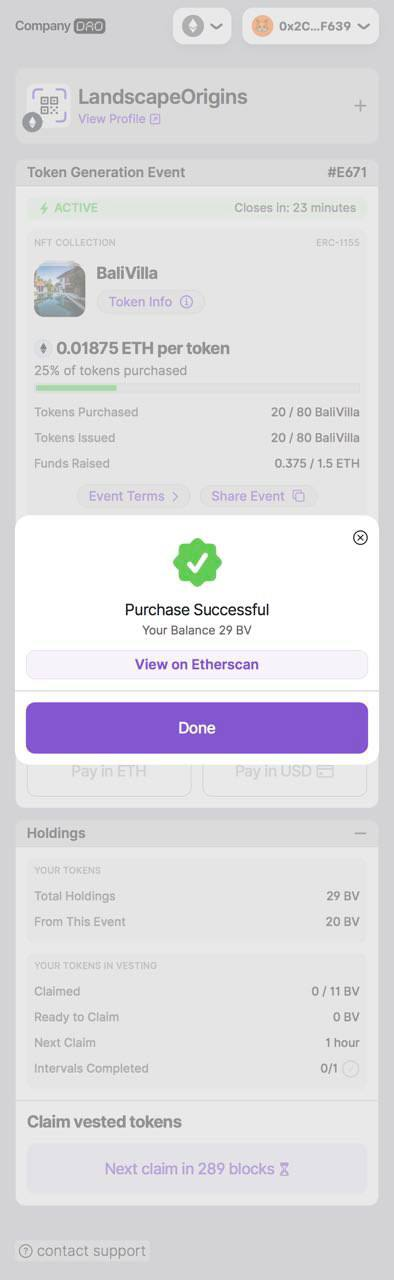

Step 2 : The DAO LLC launches a token offering via the Company DAO web app. This is a direct token offering in which tokens are issued and sold by the DAO LLC smart contract to investors. The tokens issued represent a claim on the income generated by the assets held by the DAO LLC. A link to the token offering page on the CompanyDAO web app is displayed on the tokenisation operator’s website. Investors follow the link to purchase the tokens for crypto or fiat, using the integrated fiat on-ramp.

Step 3 : Once all of the tokens on offer have been purchased by investors, the DAO LLC can purchase the lease or title to the property on offer. The DAO LLC can set a soft cap for the token offering to guarantee a minimum investment contribution. This way, if not enough tokens have been purchased, participants can redeem their tokens directly from the token offering page and claim back their funds.

Step 4 : The tokenisation operator manages the property via a separate agreement with the DAO LLC. Any income generated from the property is deposited into the DAO LLC treasury. If the income is digital assets, these assets will be deposited directly into the DAO LLC treasury. Alternatively, if the income is generated in fiat, the funds are deposited into the DAO LLC’s bank account (this account is set up by Company DAO) and converted into digital assets using on/off ramp integration provided by Company DAO. This income is then payed from the DAO LLC treasury directly to token holders.

Securities Compliance

For the this project, the tokens will be offered under the Reg S exemption. Regulation S (Reg S) provides exemptions from the registration requirements under Section 5 of the U.S. Securities Act of 1933 for offers and sales of securities that occur outside the United States. It’s designed to make it easier for U.S. issuers to raise capital in foreign markets and for non-U.S. issuers to access the U.S. capital markets without having to navigate the full array of U.S. securities registration requirements.

The Company DAO web app provides integrations with KYC verification providers which allows clients to implement regional restrictions on who can access token offerings.

Contact Us

If you are interested in tokenising your business or assets, contact us at email@companydao.org to book a free consultation.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as legal or financial advice. Readers should consult with their own legal or financial professionals before making any decisions or taking any actions based on the content of this article.

Company DAO | Telegram | Twitter (X) |YouTube | Medium |